When Covid-19 hit and a local company was figuring out how to pivot from manufacturing kayak components to PPE (personal protective equipment), one of the places they turned for help was the local Small Business Development Center, headquartered at Longwood University.

The switch from making fishing rod mounts and paddle holders to masks and face shields turned out to be the easy part, said YakAttack president Luther Cifers.

Innovation is important. We help owners brainstorm what they can change about their businesses that will allow them to be successful.

Sheri McGuire ’91, Executive Director Tweet This

“We’re manufacturers, and we’re a very agile company,” he said of the Farmville business. Using filters commonly found in HVAC systems, the company quickly developed masks for the general public that provide better protection than cloth masks. “Determining who needs this kind of PPE and how to get them into the supply chain is where we needed help,” he said.

A Prince Edward County official connected Cifers with the SBDC office in Farmville, which provides services—at no charge—to small businesses in a 26-county region of central Virginia. Executive Director Sheri McGuire ’91 and her staff then worked with him to identify potential markets for YakAttack’s new products.

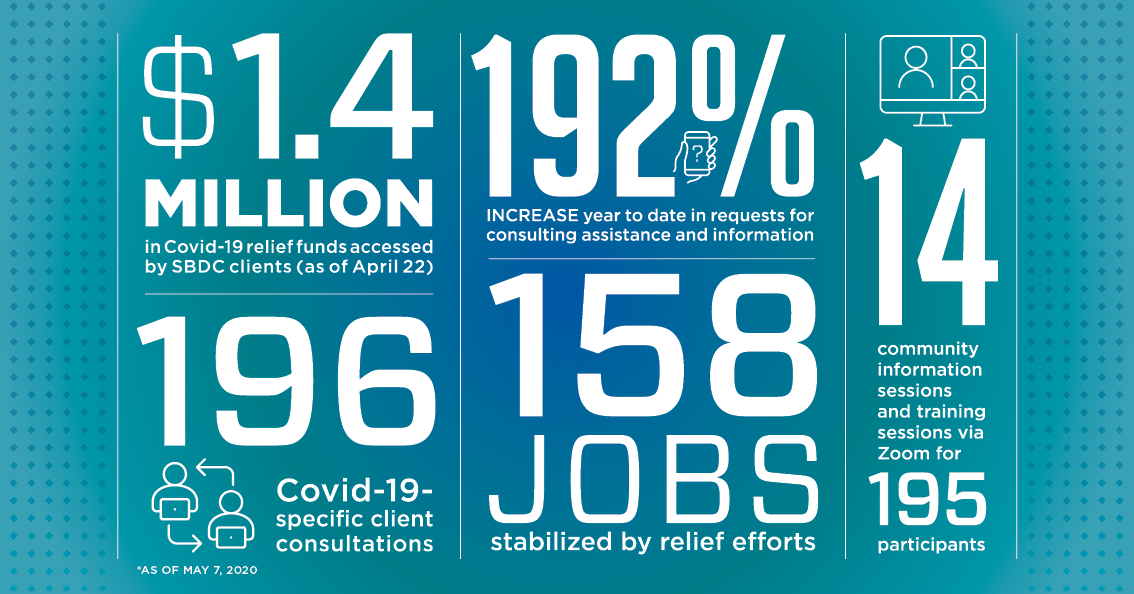

That consultation is part of a surge in requests that have tripled since this time last year, much of the increase attributable to the pandemic, McGuire said. SBDC staff are helping clients meet the challenges of the pandemic individually as well as in group sessions.

In one initiative, SBDC is bringing in experts to provide industry-specific programming—for example, in the restaurant business and retail operations—as well as guidance in marketing, finance and accounting. Since March nearly 200 business owners and employees have participated in program sessions, all offered via Zoom, McGuire added.

SBDC staff also have been working with clients to apply for federal programs such as the Paycheck Protection Program and Economic Injury Disaster Loans. So far SBDC clients have received $1.4 million in Covid-19 relief funds, she said.

YakAttack received some of those funds as did The Fishin’ Pig and North Street Press Club, whose owners, including Nash Osborn, consulted with SBDC.

“We had been in constant contact with our banking institution from Day 1. And there were a lot of calls with Sheri back and forth throughout the application process,” said Osborn. “The information was very fluid, changing hour by hour. For two to three weeks we spent the better part of every day working on how to get the funding and figuring out how could we use it. It was such a learning curve for everyone involved, from the bank to us to Sheri to the national Small Business Administration.”

McGuire said YakAttack’s quick response in retooling their manufacturing operation is a good example of the business creativity that will be required now and in coming months for small businesses to survive.

“There’s a need for business models to change long term because Covid-19 has changed everything,” she said. “Innovation is important. We help owners brainstorm what they can change about their businesses that will allow them to be successful. The initial response was taking things online. I think you’ll see more adaptations as we go through this year. Long term what you’re going to see is more efficiencies and diversifications in markets, products and services.”

The Longwood SBDC is part of a national network hosted in part by the Small Business Administration, and is one of more than 20 local SBDC offices in Virginia. Funding is provided by the SBA, Longwood University, and local county governments and economic development organizations.

Leave a Comment